The Public Provident Fund's (PPF) USP is its EEE tax status, i.e., at the time of investment, interest earned during the investment period, and the maturity proceeds are not taxable in the hands of the investor.

However, the scheme does come with a long lock-in period of 15 years. Did you know that you can have liquidity in the form of loans and withdrawals from your PPF account? Before you rush to get a loan or withdraw from your PPF, you know that this facility is subject to certain conditions.

Rules for taking a loan from a PPF account

A subscriber is eligible to take a loan from PPF account from the third financial year but this facility is available only till the end of the sixth financial year. What this means is that if the account was opened during the financial year, say 2014-15, then you are eligible to get a loan from the financial year 2016-17 (April 1, 2016) and until 2019-20 (March 31, 2020).

Do keep in mind that you cannot use the entire balance in the PPF to avail of the loan. The loan amount is capped at a maximum of 25 per cent of the balance available at the close of two years immediately preceding the year in which the loan is being applied for.

Say, you apply for the loan any day during the FY 2017 -18 then you will be eligible for the 25 per cent of the balance in your account as on March 31, 2016. The balance will be the closing inclusive of interest credited to your account on March 31.

Similarly, if you want to apply for a loan in the next financial year (2018-19), then the amount will be calculated on 25 per cent of the balance as on March 31, 2017.

Interest rate charged on the loan taken from the PPF account is two per cent higher than the prevailing interest rate set by the government. If you visit your PPF branch today to apply for a loan, then the interest rate charged on the loan will be 9.8 per cent (2% + Interest rate for the quarter ending December 2017).

Also, as the government announces the interest rate for every quarter, the interest rate charged on the loan, too, will vary accordingly.

However, once the interest rate is set for the loan then the same rate will be applicable until the repayment period.

Here are a few conditions you should know of once the loan is approved.

*You will not be eligible for a new loan until the old loan has been paid off along with interest.

*The loan taken from PPF has to be returned within 36 months.

*The tenure of 36 months is calculated from the first day of the following month in which the loan is sanctioned. For example, if the loan was sanctioned on any day of July, then the tenure of 36 months of the loan starts from August.

*In case the loan is not repaid within 36 months, then the applicable interest rate would be 6 per cent from the date the loan was sanctioned till the loan has been repaid.

*In case the loan is not repaid within 36 months, then the applicable interest rate would be 6 per cent from the date the loan was sanctioned till the loan has been repaid.

*In case any interest or part of it remains due but the principal is repaid, then the outstanding interest will be debited from the subscriber's account if it remains unpaid during the tenure of loan, i.e., 36 months.

*The repayment of principal amount of must be done either as a lump-sum or in two or more monthly instalments.

*Once the principal amount is paid, then only can you pay the interest on the loan amount.

*You cannot make the repayment of interest in more than two monthly instalments.

*Once the repayment of principal of loan starts, you can check the amount credited into your PPF account. However, the interest paid on the loan is accrued to the government.

Rules of withdrawal from PPF

You can withdraw from your PPF starting from the seventh year. So, if you go back to our above-mentioned example, for an account that was opened in 2014-15, the withdrawal facility will start from the April 1, 2020.

There are limits on the amount of money that you can withdraw from the account.

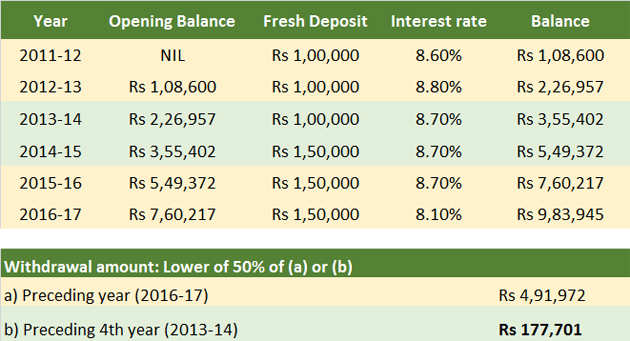

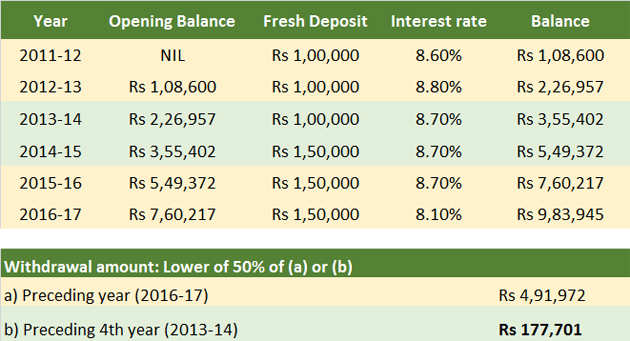

As per the PPF scheme rules, a person can withdraw lower of the following:

a) 50 per cent of the balance available at the end of fourth year immediately preceding the year of withdrawal; or

b) 50 per cent of the balance stood at the end of the preceding year

For instance, if your PPF account was opened during the financial year 2011-12 and if you visit the branch any day during FY2017-18 to apply for a loan, then the amount you are eligible calculated as:

If there is any loan taken by the subscriber earlier which remains unpaid at the time of withdrawal, then it will be subtracted from the withdrawal amount he/she is eligible for. Further, this facility is available only once a year.

Premature closure of PPF account

As per earlier rules, a PPF account could not be closed before maturity of 15 years. However, the government, by amending the Public Provident Fund Act in 2016,has allowed premature closure if either of these conditions are met:

a) The account must have completed five financial years and,

b) The amount is required for the treatment of serious ailments or life-threatening disease of the account holder, spouse, dependent children or parents, or,

c) For higher education of account holder or in case of a minor account holder.

The subscriber will have to produce supporting documents as required.

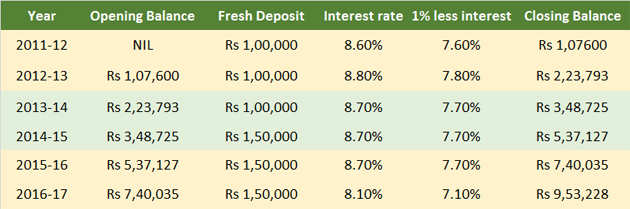

However, there is a catch. You will not get the full amount as shown in your account. As per the amended rules, if a person wishes to use the premature withdrawal facility, he or she will be subjected to one percent less interest rate from the interest rate as applicable to him in case he or she has not opted for the facility.

This can be explained as follows for an account opened in the financial year 2011-12:

From the above table it is clear that since you have opted for the premature withdrawal facility, the interest applicable for your deposits have been reduced by 1 per cent (from 8.60% to 7.60% in FY 2011-12 and so on).

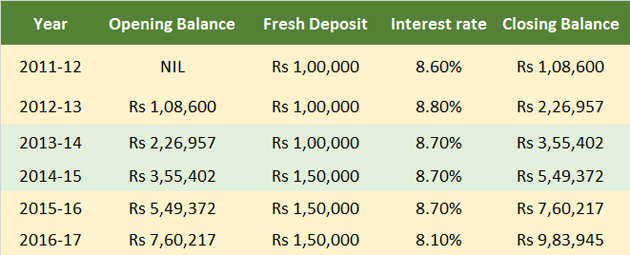

Had you not exercised the option of premature closure the balance shown in your account for the FY 2016-17 would be as:

Source:-The Economic Times